9 Golden Benefits of Mutual Fund Investment in India

- Nov 03, 2023

- 0 Comments

- Mutual Fund, Personal Finance

Benefits of mutual fund investment in India

“Why Every Investor Should Consider Mutual Funds” and “Why Mutual Funds”

As India is a developing economy, Investor has the golden benefits of mutual fund investment in India due to the following unique advantages.

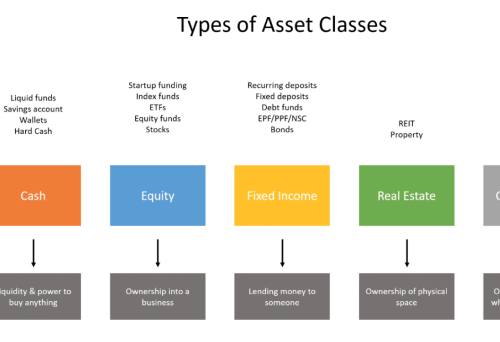

1. One Window – Mutual Fund is managed through one window with all possible investment objectives like equity, fixed income, gold, silver, and real estate. We can also select different options like growth, dividend, switching, SIP, SWP, or STP through one window only, which enables investors to manage easily and fast with balancing risk.

2. Like a Gennie – Mutual fund is like a Gennie for investors. It fulfills all the investment wishes and needs good returns, returns with security, high risk, low risk, child education, retirement planning, tax benefit, protecting capital, regular income, dividend, through sip mode, through lumpsum, etc. Investors can take benefit of high-risk high returns and low-risk low returns perfectly.

3. Diversification of Risk – This is a top of all benefit of mutual funds. The most advantageous feature for investors. First diversification does at the time of scheme selection according to risk appetite by investors called generally asset diversification. The second diversification is done by a fund manager within a fund called security diversification. Diversification made it easy to create wealth over a longer period due to risk management. “Don’t put all your eggs in one basket” automatically does by mutual fund investments. In mutual funds, the risk of one asset class or security is covered by another asset class or security in the portfolio. You may not lose the entire value as your other assets will generate returns that average out at the portfolio.

4. Professional Manager – Mutual funds are managed by professional persons dedicated to your fund. Here one certified person is there to guide or advise you and another professional person is there to manage your fund called a fund manager who is qualified, experienced, and equipped with a research team manage to dedicate your money.

5. Most Transparent – Mutual funds are the most transparent investment option. One of the most transparent features of mutual funds is NAV (net asset value) that is they have to prepare and close fund-wise accounts every business day considering every asset, income, and expense. They have to disclose regularly the what, when, how, and why of the portfolio process, like the fund’s objective, investment policy, portfolios, expenses ratio, etc. They are strictly regulated by SEBI.

6. Highly Customised – Investors can have options to select as per their needs and requirements, MFs are for all smaller or bigger investors. They can customize their portfolio as per changing needs through switches, STP, or redemptions. They have options for investments directly or regularly. They have the option to transact physically and digitally also.

7. Beating Inflation – Mutual fund has the inherent power to beat inflation. If investors make a basic strategy to invest through funds, they can beat inflation regularly.

8. Low Cost – Mutual Funds are managed at low cost. SEBI has put a limit on maximum TER and the expenses ratio is lower as the size of the fund increases. So mutual funds have lower management cost compared to other options of investments.

9. Easy to Manage – Investing process for mutual funds is very easy, they have one KYC system for all mutual funds. They have one folio system for one AMC. They can be transacted through many different platforms at a time without many restrictions.

Looking to the above unique benefits of mutual fund investment in India investors should invest through mutual funds to fulfill their financial goals by taking reasonable risks. This is the best option to create wealth by mitigating inflation, benefitting from taxation, and investing in different asset classes, with different risk and returns through low-cost professional fund managers.

Questions and Answers – Are Mutual funds generating guaranteed returns? – No mutual funds are not generating guaranteed returns they are subject to market risk. But with the help of professionals, we can create good returns and wealth in a longer period.

Author Hinen Shaah

Disclaimer

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax, and financial implications of the investment/participation in the scheme.

Happy Wealth

Note: – This information is only for educational purposes. The investments discussed here are not recommendatory. Always invest through scheme-related documents and investments are subject to market risk.

Disclaimer: – Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax, and financial implications of the investment/participation in the scheme.