AIF – Alternative Investment Fund

The Alternative Investment Fund name suggests it is an alternative to other investment options. AIF is a new age Investment. AIF works similar to Mutual Funds (MFs) or Portfolio Management Services (PMS) but MFs and PMS have many restrictions. They cannot invest in private equity, venture capital funds, unlisted shares, start-ups, credit-based investments, hedge funds, etc.

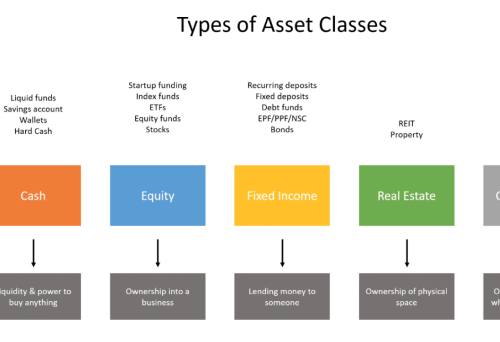

Alternative Investment Fund has a special investment that differs from traditional investment options. AIFs can invest in private equity, venture capital funds, unlisted shares, start-ups, credit-based investments, hedge funds, listed equity, bonds, debts, commodities, unlisted or low-rated debt paper, other AIFs or FOFs, Private Investment in Public Equity Funds (PIPE), etc. It is a privately pooled fund. It is a complex product with high diversification and high risk. It has a higher risk than mutual funds.

AIFs can be formed as a company, Limited Liability Partnership (LLP), trust, etc. This investment vehicle is regulated under the SEBI (Alternative Investment Funds) Regulations, 2012, guidelines. It is a privately pooled fund. It is a complex product with high risk. It has a higher risk than mutual funds.

Investor Eligibility Criteria of the AIF scheme

- RI, NRIs, and foreigners can invest in these funds.

- Minimum Investment amount of Rs. 1 Crore, for every fund

- Minimum Investment amount of Rs. 25 Lakhs, for managers and employees of the AIF

- Minimum lock-in period of three years

- Each fund require minimum AUM 20 Crore

- Maximum Number of Investors shall be 1000

- Maximum Number of Investor in angel fund up to 49

AIFs are mostly close-end investments for 4 to 7 years. The investor has to start with a minimum of Rs. One crore for AIFs, due to this restriction in minimum investment, HNIs or Institutional or corporate investors can afford and understand the high-risk, returns with substantial investments. AIF’s managers and employees can invest with a minimum amount of 25 lakhs instead of 1 crore.

Advantages of AIF investments

- Wholesale Amount – A higher minimum amount entry allows fund managers to take risks and maximize returns.

- True Diversification – These funds are highly and truly diversified among assets and securities. It protects against any crisis and provides a rebalance opportunity.

- High Return Opportunity – High Risk, Higher Diversification, avail High Return Potential.

- Less Market Volatility – It has low equity relations so the effect of market volatility becomes low.

Concerns

- Complicated product structure.

- Exit option is not easy before tenure, it is possible through transfer of portfolio to new investor only.

- Fees are not simply charged, there are expense ratios as well as performance-based fees.

Three types of AIFs are available as per SEBI regulatory 2012.

Category I – This type of AIF invests in start-ups, SMEs, and new business models through angel funds, venture capital funds (VCF), social venture capital funds, infrastructure funds, etc. Start-ups who do not get VCF can get investment in this category through angel investors. Angel investors can invest by a minimum of Rs. 25 lakh investment amount instead of Rs. 1 crore.

Category II – This type of AIF does not fall into Category I and Category II. It does not take any leverage or borrowing except for operational requirements. They are close-ended. In this category generally, real estate funds, private equity funds, and distressed asset funds, debt funds are registered. No incentive or concession was given by the government.

Category III – This type of AIF can be open-ended or closed end. It invests through complex trading strategies with leveraging through listed and unlisted securities. In a close-ended fund, an investor can not enter and can exit after the scheme ends. Hedge funds and Private Investment in Public Equity Funds (PIPE) are registered under this category.

Conclusions – AIFs are a very good investment option for HNI and above, with high returns at a good risk-reward ratio.

Note: – This information is only for educational purposes. The investments discussed here are not recommendatory. Always invest through scheme-related documents and investments are subject to market risk.

Disclaimer: – Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax, and financial implications of the investment/participation in the scheme.

Previous

Previous