Types of Asset Classes for Wealth Creation

- Nov 20, 2023

- 0 Comments

- Bond, Gold, Mutual Fund, Personal Finance, Stock

3 Great types of Asset Classes for Wealth Creation

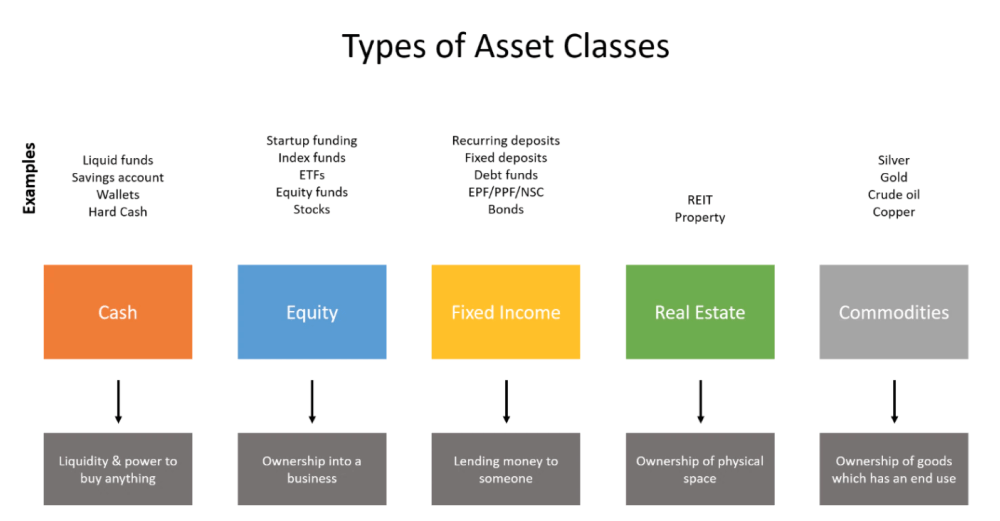

Investor requires either safety, returns or liquidity for their investments. According to the risk profile, investment horizon, and financial goals, an investor can choose from different types. There are many types of asset classes for wealth creation but there are broadly three types of investments in the world. These 3 great types of asset classes are more famous for money making across the world.

- Real Estate

- Commodities

- Bullion

- Art

1. Physical Assets class – Physical assets of investments refer to tangible assets that have financial value and can generate income or profits for investors. These assets include real estate properties, machinery and equipment, infrastructure, precious metals, art collections, and commodities such as oil and gas. These assets are generally viewed as stable and long-term investments that have the potential to appreciate in value over time in the form of income or capital gains. Physical assets are a popular investment option for many investors because they offer the potential for long-term growth and income generation. Investors may also choose physical assets to diversify their portfolio and hedge against inflation. Unlike stocks or bonds, physical assets have intrinsic value that is not dependent on market fluctuations or economic conditions. However, physical assets also come with risks such as maintenance costs, market fluctuations, and the potential for damage or destruction. It is important for investors to carefully consider their investment objectives, risk tolerance, and financial situation before investing in physical assets.

Note: Types of Physical Assets for Investments are Real Estate, Commodities, Bullion, Art, etc

2. Financial Assets class – Financial assets of investments refer to paper investments that has a financial value and is held by an investor or investment futures, and derivatives. Financial assets are generally traded in financial markets and are used to generate income, capital gains, or as a means of hedging against financial risks. The performance of these investments determines the returns that investors receive on their investments, making it crucial for investors to carefully evaluate the risks and potential returns associated with each asset before investing. Financial assets have two major type Stocks and Fixed Income Securities.

Note: Types of Financial Assets for Investments are Equity, Debts, Money Market, Mutual Funds, Insurance, Small Savings, etc

3. Digital Assets class – Digital assets of investments refer to any type of investment or financial asset that exists purely in a digital form. These assets can include cryptocurrencies such as Bitcoin and Ethereum; digital tokens. Digital assets offer investors a range of benefits including faster transaction times, increased liquidity, and improved transparency. Additionally, they offer investors access to decentralized finance (DeFi) platforms, which allow them to earn interest on their digital assets, borrow funds, and invest in a range of different assets. However, investing in digital assets also comes with its risks, including price volatility, regulatory uncertainty, and the risk of hacking or fraud. As such, investors should do their due diligence before investing in digital assets. These assets are used by investors globally as an alternative investment vehicle to traditional securities such as stocks, bonds, and mutual funds. They also require a certain level of technical knowledge and understanding to invest and manage effectively

Note: Types of Digital Assets for Investments are Crypto Currency, Digital Coins, NFTs, E Rupee, Pocket

There are three ways to make money through above investments assets. Firstly, you can lend money to a person, business, or the government in exchange for interest. Secondly, you can become a part-owner of a company by purchasing shares. Finally, buying assets like real estate or bullion that tend to increase in value over time is a viable option.

So out of above discussion there are 5 types of investments assets classes in India :

- Real Estate

- Fixed Income Securities

- Equity Market

- Commodities

- Alternate

Author Hinen Shaah

Happy Wealth

Note: – This information is only for educational purposes. The investments discussed here are not recommendatory. Always invest through scheme-related documents and investments are subject to market risk.

Disclaimer: – Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax, and financial implications of the investment/participation in the scheme.

Previous

Previous