Wealth Creation similar to Child Growth

Today out of my experience, I will share my thought on how wealth creation and the growth of a child has similarities.

Wealth creation is just like a baby-to-adult journey. So growing a baby and growing money has similar nature. I think money management and the growth of a child have many similarities. We should develop both the child, one biological child and another in the form of money. At least one or both will be your assets ever.

We grow our children with a lot of patience, care, emotions, nurture, and discipline. The child needs the guidance of parents and parents, ignoring others and it is a long years of process. Baby grows with crawling to baby steps to normal steps and to run.

- Long Term – Wealth creation can be achieved through long years of Savings and Investments compound. A child needs time of at least 15 to 20 years to become mature same investments also require time to grow at least 15 to 20 years.

- Patience and Emotions – You can create wealth through patience in all situations for all asset classes. It may be ups and downs like child life but we should stick with our objective as planned.

- Care and Nurture – We should take care and nurture our investment portfolio’s quality by reviewing and reshuffling regularly like a child’s career. Diversification is also a part of it.

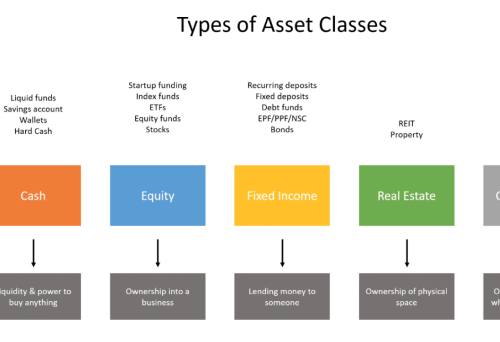

- Discipline – Investment is a subject of strict discipline of asset class, we shall not quit asset class frequently without checking our risk appetite. We may change instruments but not an asset class.

- Expert Guidance – Experts are like parents in wealth creation. They provide the right advice at the right time with the right quality and quantity. Experts or advisers can help you to control your emotions and keep you on the right track. They are philosophers in bad times.

- Ignore others – As parents ignore others when it is a matter of their own child. In the same way, we should ignore others like short-term trends, tips, trading, media news, or friends and relatives.

- Baby to Man – First baby crawl in Wealth creation is a piggy bank that slowly turns into baby steps like a savings account which turns into normal steps like fixed income securities then it turns into running steps like investments and last both baby and money reach to capacity to achieve whatever they want that is called wealth creation.

Note: – This information is only for educational purposes. The investments discussed here are not recommendatory. Always invest through scheme-related documents and investments are subject to market risk.

Disclaimer: – Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax, and financial implications of the investment/participation in the scheme.

Previous

Previous