Saving and investing are two essential pillars of financial well-being. While both involve setting aside money for the future, they serve different purposes and have distinct characteristics. In this blog post, we will explore the difference between savings and investments, their respective benefits, and how they contribute to building a strong financial foundation.

Savings

Savings refer to the portion of your income that you set aside for future use. It typically involves placing money in a savings account or a low-risk financial instrument, such as a certificate of deposit (CD). The key features of savings include:

- Liquidity: Savings are easily accessible, allowing you to withdraw funds when needed without any significant penalties or restrictions.

- Safety: Savings in bank accounts are typically insured by government-backed programs, providing protection against the loss of funds up to a certain limit.

- Stability: Savings offer a stable and predictable return in the form of interest, although the interest rates may be relatively low.

- Short-term focus: Savings are primarily meant to address short-term financial goals, emergencies, or unexpected expenses.

Investments:

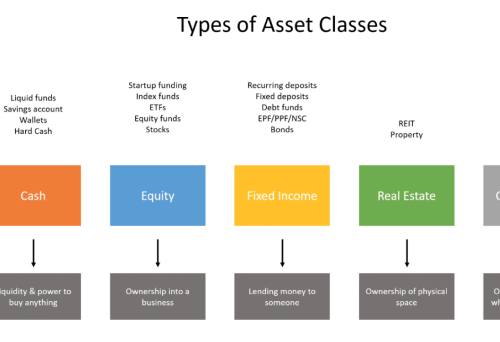

Investments, on the other hand, involve allocating money with the expectation of generating a return or achieving long-term financial goals. Investments can take various forms, including stocks, bonds, mutual funds, real estate, or business ventures. The key features of investments include:

- Potential for higher returns: Investments have the potential to generate higher returns compared to traditional savings accounts, but they also come with a higher level of risk.

- Diversification: Investments allow you to diversify your portfolio by allocating funds across different asset classes to manage risk and maximize potential returns.

- Long-term focus: Investments are typically geared towards long-term financial goals, such as retirement planning, education funding, or wealth accumulation over time.

- Market volatility: Investments are subject to market fluctuations, and the value of your investment can go up or down depending on various economic and market factors.

Balancing Savings and Investments

Both savings and investments play crucial roles in financial planning. It’s important to strike a balance between the two based on your individual circumstances, goals, and risk tolerance. Consider the following factors:

- Emergency fund: Build a savings cushion to cover unforeseen expenses or emergencies, typically equivalent to three to six months’ worth of living expenses.

- Short-term goals: Use savings to meet short-term financial goals, such as saving for a down payment, purchasing a car, or planning a vacation.

- Long-term goals: Invest in vehicles like stocks, bonds, or mutual funds to generate returns that can help achieve long-term goals like retirement planning or funding higher education.

- Risk tolerance: Assess your comfort level with market volatility and choose investment options accordingly. Diversification and consulting a financial advisor can help manage risk effectively.

Understanding the difference between savings and investments is crucial for building a solid financial foundation. Savings provide liquidity, safety, and stability for short-term needs, while investments offer the potential for higher returns over the long term. By striking the right balance between savings and investments based on your goals, risk tolerance, and time horizon, you can make significant progress toward achieving financial security and growth. Remember to regularly review and adjust your savings and investment strategies as your financial circumstances and goals evolve.

Note: – This information is only for educational purposes. The investments discussed here are not recommendatory. Always invest through scheme-related documents and investments are subject to market risk.

Disclaimer: – Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including the fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax, and financial implications of the investment/participation in the scheme.

Previous

Previous